Taiwan Auto Lamp Makers Shine in Global Aftermarket

Jun 25, 2004 Ι Industry News Ι Auto Parts and Accessories Ι By Quincy, CENS

After 20 years or so of vigorous development, Taiwan's auto-lamp makers have achieved renown in the global aftermarket for the comprehensive range, high quality, and reasonable prices of their products.

Small as it is, Taiwan has a number of major players in the worldwide auto-exterior light market in terms of shipping volume and range of product lines.

This success in due to strong R&D and innovation efforts, constant investment, solid management, and strong manufacturing capability. In addition, comments Hu Yuan-long, manager of Depo Auto Parts Ind. Co., one of the island's largest auto-lamp makers, his industry also benefits from mold and die development costs that are lower than Japan's and that have a much higher level of precision than mainland China's. In Japan, it costs about NT$10 million (a little over US$300,000 at NT$34.1:US$1) to develop a set of molds and dies for a headlamp; in Taiwan the cost is only half that, and in mainland China a quarter. But Taiwan's molds and dies are equal to Japan's in sophistication, and their quality cannot be matched by competitors in mainland China.

Nevertheless, the island's manufacturers in the line fully realize that they must remain cost-competitive, and have begun a series of aggressive actions in the areas of manufacturing capability, R&D, and offshore production.

Depo Auto Parts is one of Taiwan's three largest companies in the line, having grown from a small maker of side mirrors and truck lights three decades ago into a leading auto-lamp maker with a global reputation. Its revenues have grown at an average 10% annually over the past several years.

Today, the company supplies all kinds of exterior auto lights including head, tail, auxiliary, fog, and side lamps. Continuous investment in mold and die development has given Depo a huge product line that now encompasses more than 14,000 items.

Having the same role on a car as eyes for a human being, Hu stresses, a lamp is judged not only by its brightness but also by its safety in day and night driving and in all kinds of weather. Depo, therefore, treats each of its lamps not only as an illuminator but also as a protector of drivers.

Importance of Marketing Strategy

Hu says that Depo's success is due partly to the adoption of the correct marketing strategy. After gaining a solid foothold in the domestic market, it decided to focus on the overseas aftermarket as a means of escaping from the constraints of Taiwan's limited size. It still supplies lamps to a few domestic automakers, but considers that own-brand sales in the international market have much greater potential. The company also realizes that it can develop an image for high quality by engaging in the supply of original equipment (OE) products.

If Depo continues its aggressive development of molds and dies, Hu says, newcomers to the line will find it difficult, or even impossible, match the comprehensiveness of its product line.

The manager goes on to say that Taiwan is an ideal place for the production of auto lamps because of its internationally respected high-quality labor force, strong development and innovation capability, and good manufacturing and management abilities. The island's global competitiveness is further strengthened by its small-batch, large-variety mode of production.

Depo operates four plants with a total of more than 1,000 workers in Taiwan, as well as a branch responsible for North America, three inventory warehouses in the United States, and six distribution points spread elsewhere worldwide. Another plant was built in Shanghai a few years ago as part of the company's global division-of-labor scheme, which is aimed at making it more competitive and flexible in the years ahead.

The Taiwan plants will be used to produce mainly new items, Hu says, and to develop molds and dies for products turned out overseas as well as at home. This division of labor, the manager comments, will give his company a complementary array of product lines and stronger price and quality competitiveness by allowing the most efficient allocation of resources.

Fog Lamps in the Forefront

Another company at the forefront of the industry is Yungli Traffic Equipment Co., which markets its products all over the world under the "Satuga" brand. Established in 1988, Yungli is a highly experienced maker of a wide range of auto lamps including head lamps, auxiliary lamps (spot, driving, and off-road driving lights) for both the aftermarket and original equipment market. It also turns out lamps for other types of vehicles such as motorcycles, agricultural machines, and boats, and makes harnesses as well.

The company's president, Chen Yu-jen, says that intensive investment in mold and die development has given Yungli a comprehensive range of products that includes 360 models of fog lamps. This, the president claims, makes his company the most comprehensive supplier of fog lamps in the world.

Yungli's Taiwan plant has about 50 workers who turn out about 200,000 lamps per month. This is not enough to meet the demand, so plans are afoot to set up a large new plant in Dongguan, Guangdong Province, this year.

Chen claims that Yungli has earned a global reputation by insisting on the use of only the best parts and components, including high-end halogen bulbs made in Taiwan or South Korea. Once the market for high-intensity-discharge (HID) lamps is mature, he says, the company will move into that line as well.

The company exports about 90% of its production and sells most of the rest to other local lamp products in the interest of container consolidation. A small quantity of products is sold to local automakers on an original-equipment basis.

Chen notes that auto-lamp production requires large investments in mold and die development, the procurement of optical-design technology (especially for reflectors) and overseas quality and safety certification. He says that his lamps meet the strictest E-mark and Society of Automotive Engineers (SAE) safety standards.

To make sure that its lamps are stylish in appearance as well as safe in function, Chen says, R&D department regularly adds to the largest database for fashion information in the market and tries to improve on existing models.

Yungli maintains long-term cooperative ties with professional optical-design companies with the aim of obtaining the most advanced reflector designs for a variety of lighting sources and reflector materials. In refining designs, the company's R&D department considers other relevant details such as heat dissipation and optimum lamp size. In recent years the company has increasingly adopted advanced optoelectronic modules in its designs, including electro-luminescent (EL) rings and color-changing light-emitting diode (LED) modules. This has helped with the promotion of the company's products in the performance-tuning market.

The company develops 10 to 20 new auto-lamp models every year. This constant flow of new offerings is one of its strongest advantages, Chen says, since it has allowed Yungli to build up its product line to the point where the firm has become a one-stop-shop for its customers. To meet future needs, the marketing and R&D divisions will be expanded.

Precocious Newcomer

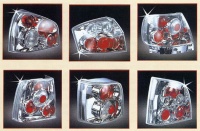

IP Import Export Co. is a relative newcomer to the car-modification and accessories line, having entered it just two years ago on the back of its strong design and mold-development capabilities as well as rich store of accumulated experience and know-how. After carrying out extensive studies, the company decided to concentrate on the development of replacement taillights and accessories such as door and trunk-lid moldings, brake lights, side markers, and light trim, mainly for European cars.

P.J. Lu, the company's general manager, says that all of his firm's taillights feature state-of-the-art design, comprehensive and innovative functions, the highest quality, and conformity with ECE standards.

He decided to concentrate on the European market, Lu explains, because competition in America and Japan is too intense.

Taillights are the most important of all exterior auto parts, Lu says; and, thanks to their brightness, they offer the best cost/performance ratio in improving a car's appearance. This is why people who want to customize their automobiles generally start with the head- and taillights.

Function is even more important than appearance, Lu emphasizes, since safety is involved. This factor requires manufacturers to have professional know-how in the area of optical lens and reflector design and production.

The general manager says that as a specialized developer of plastic-injection molds, IP is well able to achieve the highest level of product quality. This level, he claims, cannot be matched by companies that turn out products mainly by outsourcing parts for final assembly. Most of his firm's taillights, he says, pass the strictest air- and water-leakage tests using top-end in-house testing equipment.

The company has built a new plant in Tainan County, where a team of skilled engineers use the most advanced computer-aided design/manufacturing (CAD/CAM) equipment in developing the high-precision molds needed to make all taillight parts. To assure the best finish, the company uses four-axis gluing-robot arms and sophisticated ultrasonic-welding machines. The superior quality of all his firm's manufacturing processes, Lu says, is the "secret weapon" that has enabled IP to rise rapidly in the international market.

With an R&D team comprised of talented professionals in such fields as optics, industrial design, and fine art, the company has been able to draw ahead of its major domestic-and even international-competitors. Its rapid development capability has enabled the company to build up a comprehensive product line of 50 to 60 taillight models in just a year and a half.

What provides a core competitive edge for makers of car-modification parts, Lu emphasizes, is quick response to market demand. This is where IP shines, as its R&D people turn ideas into new products that lead the market instead of following it. More and more foreign buyers are turning to IP, Lu claims, because it is able to develop a new item must faster and cheaper than a major manufacturer can-and, perhaps, at an even higher quality.

Another advantage that the company claims is its insistence on developing molds and making lamps in Taiwan. After developing the molds, IP contracts the actual production of auto-lamp parts to plastic injection companies and then assembles the products in-house. Its small-batch, large-variety mode of production is ideal for the car-modification parts and accessories market, which, Lu explains, is always hungry for new items in small quantities.

The company has developed a constantly growing number of taillight models for most major European car brands, including Audi, BMW, Citroen, Opel, Peugeot, Renault, Seat, and Volkswagen.

Contact information on companies covered by the article:

Yungli Traffic Equipment Co.

No. 1-2, Lane 65, Chiayuan Rd., Sec. 2, Shulin Town, Taipei Hsien, Taiwan 238

Tel: 886-2-2680-3860

Fax: 886-2-2680-3851

E-Mail: f7295@ms14.hinet.net

website: www.satuga.com

IP Import Export Co.

No. 502, Chungshan S. Rd., Yungkang City, Tainan Hsien, 710, Taiwan

Tel: (886-6) 231-9977

Fax: (886-6) 231-8877

E-mail: IP@LH-Group.com.tw

Small as it is, Taiwan has a number of major players in the worldwide auto-exterior light market in terms of shipping volume and range of product lines.

This success in due to strong R&D and innovation efforts, constant investment, solid management, and strong manufacturing capability. In addition, comments Hu Yuan-long, manager of Depo Auto Parts Ind. Co., one of the island's largest auto-lamp makers, his industry also benefits from mold and die development costs that are lower than Japan's and that have a much higher level of precision than mainland China's. In Japan, it costs about NT$10 million (a little over US$300,000 at NT$34.1:US$1) to develop a set of molds and dies for a headlamp; in Taiwan the cost is only half that, and in mainland China a quarter. But Taiwan's molds and dies are equal to Japan's in sophistication, and their quality cannot be matched by competitors in mainland China.

Nevertheless, the island's manufacturers in the line fully realize that they must remain cost-competitive, and have begun a series of aggressive actions in the areas of manufacturing capability, R&D, and offshore production.

Depo Auto Parts is one of Taiwan's three largest companies in the line, having grown from a small maker of side mirrors and truck lights three decades ago into a leading auto-lamp maker with a global reputation. Its revenues have grown at an average 10% annually over the past several years.

Today, the company supplies all kinds of exterior auto lights including head, tail, auxiliary, fog, and side lamps. Continuous investment in mold and die development has given Depo a huge product line that now encompasses more than 14,000 items.

Having the same role on a car as eyes for a human being, Hu stresses, a lamp is judged not only by its brightness but also by its safety in day and night driving and in all kinds of weather. Depo, therefore, treats each of its lamps not only as an illuminator but also as a protector of drivers.

Importance of Marketing Strategy

Hu says that Depo's success is due partly to the adoption of the correct marketing strategy. After gaining a solid foothold in the domestic market, it decided to focus on the overseas aftermarket as a means of escaping from the constraints of Taiwan's limited size. It still supplies lamps to a few domestic automakers, but considers that own-brand sales in the international market have much greater potential. The company also realizes that it can develop an image for high quality by engaging in the supply of original equipment (OE) products.

If Depo continues its aggressive development of molds and dies, Hu says, newcomers to the line will find it difficult, or even impossible, match the comprehensiveness of its product line.

The manager goes on to say that Taiwan is an ideal place for the production of auto lamps because of its internationally respected high-quality labor force, strong development and innovation capability, and good manufacturing and management abilities. The island's global competitiveness is further strengthened by its small-batch, large-variety mode of production.

Depo operates four plants with a total of more than 1,000 workers in Taiwan, as well as a branch responsible for North America, three inventory warehouses in the United States, and six distribution points spread elsewhere worldwide. Another plant was built in Shanghai a few years ago as part of the company's global division-of-labor scheme, which is aimed at making it more competitive and flexible in the years ahead.

The Taiwan plants will be used to produce mainly new items, Hu says, and to develop molds and dies for products turned out overseas as well as at home. This division of labor, the manager comments, will give his company a complementary array of product lines and stronger price and quality competitiveness by allowing the most efficient allocation of resources.

Fog Lamps in the Forefront

Another company at the forefront of the industry is Yungli Traffic Equipment Co., which markets its products all over the world under the "Satuga" brand. Established in 1988, Yungli is a highly experienced maker of a wide range of auto lamps including head lamps, auxiliary lamps (spot, driving, and off-road driving lights) for both the aftermarket and original equipment market. It also turns out lamps for other types of vehicles such as motorcycles, agricultural machines, and boats, and makes harnesses as well.

The company's president, Chen Yu-jen, says that intensive investment in mold and die development has given Yungli a comprehensive range of products that includes 360 models of fog lamps. This, the president claims, makes his company the most comprehensive supplier of fog lamps in the world.

Yungli's Taiwan plant has about 50 workers who turn out about 200,000 lamps per month. This is not enough to meet the demand, so plans are afoot to set up a large new plant in Dongguan, Guangdong Province, this year.

Chen claims that Yungli has earned a global reputation by insisting on the use of only the best parts and components, including high-end halogen bulbs made in Taiwan or South Korea. Once the market for high-intensity-discharge (HID) lamps is mature, he says, the company will move into that line as well.

The company exports about 90% of its production and sells most of the rest to other local lamp products in the interest of container consolidation. A small quantity of products is sold to local automakers on an original-equipment basis.

Chen notes that auto-lamp production requires large investments in mold and die development, the procurement of optical-design technology (especially for reflectors) and overseas quality and safety certification. He says that his lamps meet the strictest E-mark and Society of Automotive Engineers (SAE) safety standards.

To make sure that its lamps are stylish in appearance as well as safe in function, Chen says, R&D department regularly adds to the largest database for fashion information in the market and tries to improve on existing models.

Yungli maintains long-term cooperative ties with professional optical-design companies with the aim of obtaining the most advanced reflector designs for a variety of lighting sources and reflector materials. In refining designs, the company's R&D department considers other relevant details such as heat dissipation and optimum lamp size. In recent years the company has increasingly adopted advanced optoelectronic modules in its designs, including electro-luminescent (EL) rings and color-changing light-emitting diode (LED) modules. This has helped with the promotion of the company's products in the performance-tuning market.

The company develops 10 to 20 new auto-lamp models every year. This constant flow of new offerings is one of its strongest advantages, Chen says, since it has allowed Yungli to build up its product line to the point where the firm has become a one-stop-shop for its customers. To meet future needs, the marketing and R&D divisions will be expanded.

Precocious Newcomer

IP Import Export Co. is a relative newcomer to the car-modification and accessories line, having entered it just two years ago on the back of its strong design and mold-development capabilities as well as rich store of accumulated experience and know-how. After carrying out extensive studies, the company decided to concentrate on the development of replacement taillights and accessories such as door and trunk-lid moldings, brake lights, side markers, and light trim, mainly for European cars.

P.J. Lu, the company's general manager, says that all of his firm's taillights feature state-of-the-art design, comprehensive and innovative functions, the highest quality, and conformity with ECE standards.

He decided to concentrate on the European market, Lu explains, because competition in America and Japan is too intense.

Taillights are the most important of all exterior auto parts, Lu says; and, thanks to their brightness, they offer the best cost/performance ratio in improving a car's appearance. This is why people who want to customize their automobiles generally start with the head- and taillights.

Function is even more important than appearance, Lu emphasizes, since safety is involved. This factor requires manufacturers to have professional know-how in the area of optical lens and reflector design and production.

The general manager says that as a specialized developer of plastic-injection molds, IP is well able to achieve the highest level of product quality. This level, he claims, cannot be matched by companies that turn out products mainly by outsourcing parts for final assembly. Most of his firm's taillights, he says, pass the strictest air- and water-leakage tests using top-end in-house testing equipment.

The company has built a new plant in Tainan County, where a team of skilled engineers use the most advanced computer-aided design/manufacturing (CAD/CAM) equipment in developing the high-precision molds needed to make all taillight parts. To assure the best finish, the company uses four-axis gluing-robot arms and sophisticated ultrasonic-welding machines. The superior quality of all his firm's manufacturing processes, Lu says, is the "secret weapon" that has enabled IP to rise rapidly in the international market.

With an R&D team comprised of talented professionals in such fields as optics, industrial design, and fine art, the company has been able to draw ahead of its major domestic-and even international-competitors. Its rapid development capability has enabled the company to build up a comprehensive product line of 50 to 60 taillight models in just a year and a half.

What provides a core competitive edge for makers of car-modification parts, Lu emphasizes, is quick response to market demand. This is where IP shines, as its R&D people turn ideas into new products that lead the market instead of following it. More and more foreign buyers are turning to IP, Lu claims, because it is able to develop a new item must faster and cheaper than a major manufacturer can-and, perhaps, at an even higher quality.

Another advantage that the company claims is its insistence on developing molds and making lamps in Taiwan. After developing the molds, IP contracts the actual production of auto-lamp parts to plastic injection companies and then assembles the products in-house. Its small-batch, large-variety mode of production is ideal for the car-modification parts and accessories market, which, Lu explains, is always hungry for new items in small quantities.

The company has developed a constantly growing number of taillight models for most major European car brands, including Audi, BMW, Citroen, Opel, Peugeot, Renault, Seat, and Volkswagen.

Contact information on companies covered by the article:

Yungli Traffic Equipment Co.

No. 1-2, Lane 65, Chiayuan Rd., Sec. 2, Shulin Town, Taipei Hsien, Taiwan 238

Tel: 886-2-2680-3860

Fax: 886-2-2680-3851

E-Mail: f7295@ms14.hinet.net

website: www.satuga.com

IP Import Export Co.

No. 502, Chungshan S. Rd., Yungkang City, Tainan Hsien, 710, Taiwan

Tel: (886-6) 231-9977

Fax: (886-6) 231-8877

E-mail: IP@LH-Group.com.tw

©1995-2006 Copyright China Economic News Service All Rights Reserved.