Metal Furniture Taiwan Steels Up For Tough Competition

Mar 16, 2005 Ι Industry News Ι Furniture Ι By Ben, CENS

Iron and steel prices have shot up over 80% in the past year, and few are hurting more as a result than Taiwan's metal-furniture manufacturers. Metal materials account for at least 40% of their production costs, and as these costs have risen their profits have headed south. Normally producers pass higher costs on to their buyers, but with lower-cost producers this time steadfastly holding the line on prices, this traditional way out has been effectively shut down.

The one silver lining in the current situation is that buyers are eager to lock in contracts to avoid the fallout from any future price increases, which means that furniture makers have no shortage of business these days-at least in terms of volume.

Over the past decade, those of the island's metal-furniture makers that have refused the lure of low production costs in mainland China have survived by shifting to higher-margin items at the market's upper end. As part of this move, some have replaced enamel-baked items with electroplated models--a technique that mainland rivals have yet to fully master.

ODM on the Rise

King Ming Industry Co., Ltd., formerly King Long Industrial Co. is a 30-year-old specialist producer of fine iron-plate, pipe and wire furniture. The company currently focuses on original equipment manufacturing (OEM) orders, but its original design manufacturing (ODM) business is growing.

The company says that ODM is the way of the future for Taiwan since it can help local suppliers distinguish their products from those of competitors in developing nations.

The company supplies kitchen, living-room, bedroom, study, and storage/display products, as well as computer desks. All of its items are available with electroplate or baked paint finishing.

King Ming recently teamed up with the National Huwei Institute of Technology, formerly National Yunlin College of Technology, to develop the company's ability to develop DIY metal furniture, says company president Chang His-te. "The institute is now helping us design a variety of DIY products, including computer desks, sanitary and bathroom accessories, and dining carts."

Chang says the Huwei Institute has a design team of 150 students to help his company come up with innovative furniture designs that meets the demands and safety standards of the international market.

Chang says the DIY metal-furniture market is growing with the support of major hypermarkets and discount chains, including Carrefour and B&Q. Chang is positioning his company to tap this market potential.

The company will showcase all of its new designs at the 2006 Taipei International Furniture Show, slated for March 15-18 at the Taipei World Trade Center.

King Ming has a 72, 000-square-foot plant in central Taiwan. The company says the plant can be expanded to accommodate the production of new products. The firm exports over 90% of its output, mainly to the U.S., Europe, and Japan. Over the past several years the company has showcased its products at major international furniture shows in the U.K., Germany, and Singapore.

At present a majority of King Ming's products are electroplated, though the company is planning to increase its range of stainless-steel items to raise margins, Chang says. "We are planning to invest heavily in advanced production equipment to facilitate this move."

Knocking Down Europe's Doors

Phoebe & George Enterprise Co. manufactures knockdown (K/D) metal furniture and computer desks. The company's main lines are coffeetables and end tables; the firm is adding wood, glass, and other materials to enhance the appearance of models in these lines.

Phoebe & George exports mainly to the U.S., but it is now making inroads in Europe with the aid of recent big-ticket orders. The company will enhance the production of European-style products in the next few years to reflect its evolving customer base.

"European-style coffeetables are sturdy and have simple lines, " says company president George Kao.

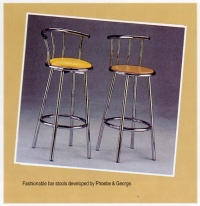

Two years ago, Kao's company began turning out bar stools, which have since become one of its hottest-selling products. Last year the company added bedroom sets to its catalog-a market that Kao feels the firm will have much success with in Europe.

Seven years ago, Phoebe & George opened a factory in the mainland China province of Guangdong. The company now operates three plants there with a total production space of 30, 000 square meters. Two of the three plants were opened last year to make new items for export to Europe. The new facilities have enabled the company to increase output by 1.5-fold from the level of a year ago.

Despite the shift of production facilities to mainland, Phoebe & George still procures high-grade iron and steel from Taiwan's China Steel Corp. (CSC) since most mainland steel is not reliable, Kao says. "We have targeted the high-end market, so we have to use high-quality materials to win the long-term confidence of our customers."

Strict quality control is another part of Phoebe & George's strategy to succeed in the upper end markets.

The company sells products on both OEM and ODM terms. Its ODM has traditionally outpaced its OEM sales, but that has changed over the past year or so, Kao says. "We especially welcome OEM orders because it guarantees our steady growth."

Phoebe & George believes that Europe is a good market for Taiwanese furniture manufacturers to expand their OEM business.

"We are also seeking foreign furniture manufacturers who have strong interest in jointly developing new products with us, " Kao says.

Big in Japan

Hsiang Shao Enterprise Co. is a veteran manufacturer of dining sets and other small indoor furniture items, many made with leather and polyvinyl carbonate (PVC).

Besides dining sets, the company also produces bar stools, clothes hangers, and occasional tables, among other high-end items at its southern Taiwan plant.

"Because of the high labor costs in Taiwan, local manufacturers need to develop high-end products, " says Kuo Jen-chih, the firm's president. "Otherwise, we can't compete with rivals in low-cost developing-economy nations."

Currently the company exports 60% of its output, mainly to Japan and South Africa. Kuo is especially optimistic about the prospects of the Japanese market following its linkup with a Japanese importer over two years ago. "The Japanese customer is very satisfied with the quality of our products, " says Kuo. "And with their help our sales to Japan have grown steadily over the past two years." Hsiang Shao will continue to develop high-end products to expand its sales to Japan in the next few years, he says.

Hsiang Shao introduces a new item every three months and it has obtained several patents in Taiwan.

Casting for Profits

Amtop Co., Ltd., founded in 1988 as Pantotex Co., Ltd., makes forged and die-cast industrial products in mainland China and Thailand with partner manufacturers there. Metal-furniture parts account for half of its total production, with construction materials and other items making up the balance.

Founded as a bicycle producer, Amtop exited the low-margin business three years ago to focus on wrought-iron and cast-iron products made at two plants in mainland China, says company president Milton Hsieh. The plants are owned by Taiwanese business associates that have a long history of producing in the mainland."

Hsieh says the firm has obtained the exclusive rights to distribute all the products made at one of the plants, located in Xiamen. "We handle all the export operations so the manufacturer can concentrate on production, " Hsieh notes.

More recently, Amtop obtained exclusive export rights from a bronze foundry located in Pattaya, Thailand. The company makes statues and vases as well as stationery, gift, and other small items.

"Although the mainland has become a world factory, Taiwanese businesspeople have used their extensive manufacturing and marketing experience to control a large portion of exports there, says Hsieh. "With more than three decades of experience in foreign trade, Taiwanese companies have won the deep confidence of international buyers."

Hsieh compares the mainland manufacturing industry to that of Taiwan's 25 years ago. "The mainland plants still rely on the assistance of Taiwanese managers, " he says.

Taiwan has lost ground to mainland producers, but Hsieh still believes that Taiwan can succeed in the international market by focusing on high-added-value products. "Manufacturing is an important benchmark of a nation's power, " he says. "What Taiwan needs the most is creativity and innovation. By enhancing research and development, Taiwan can remain an ideal place for sourcing reliable products."

Amtop plans to open a business headquarters with R&D operations in Taiwan. The company is also introducing a new corporate image and logo.

"Wages in Taiwan are higher than in neighboring countries, but Taiwan has a huge pool of talented people who can quickly design new products, " Hsieh says. "In addition, Taiwan is experienced in delivering products fast. This is a key consideration for buyers in this era of ever-intensifying global competition."

The one silver lining in the current situation is that buyers are eager to lock in contracts to avoid the fallout from any future price increases, which means that furniture makers have no shortage of business these days-at least in terms of volume.

Over the past decade, those of the island's metal-furniture makers that have refused the lure of low production costs in mainland China have survived by shifting to higher-margin items at the market's upper end. As part of this move, some have replaced enamel-baked items with electroplated models--a technique that mainland rivals have yet to fully master.

ODM on the Rise

King Ming Industry Co., Ltd., formerly King Long Industrial Co. is a 30-year-old specialist producer of fine iron-plate, pipe and wire furniture. The company currently focuses on original equipment manufacturing (OEM) orders, but its original design manufacturing (ODM) business is growing.

The company says that ODM is the way of the future for Taiwan since it can help local suppliers distinguish their products from those of competitors in developing nations.

The company supplies kitchen, living-room, bedroom, study, and storage/display products, as well as computer desks. All of its items are available with electroplate or baked paint finishing.

King Ming recently teamed up with the National Huwei Institute of Technology, formerly National Yunlin College of Technology, to develop the company's ability to develop DIY metal furniture, says company president Chang His-te. "The institute is now helping us design a variety of DIY products, including computer desks, sanitary and bathroom accessories, and dining carts."

Chang says the Huwei Institute has a design team of 150 students to help his company come up with innovative furniture designs that meets the demands and safety standards of the international market.

Chang says the DIY metal-furniture market is growing with the support of major hypermarkets and discount chains, including Carrefour and B&Q. Chang is positioning his company to tap this market potential.

The company will showcase all of its new designs at the 2006 Taipei International Furniture Show, slated for March 15-18 at the Taipei World Trade Center.

King Ming has a 72, 000-square-foot plant in central Taiwan. The company says the plant can be expanded to accommodate the production of new products. The firm exports over 90% of its output, mainly to the U.S., Europe, and Japan. Over the past several years the company has showcased its products at major international furniture shows in the U.K., Germany, and Singapore.

At present a majority of King Ming's products are electroplated, though the company is planning to increase its range of stainless-steel items to raise margins, Chang says. "We are planning to invest heavily in advanced production equipment to facilitate this move."

Knocking Down Europe's Doors

Phoebe & George Enterprise Co. manufactures knockdown (K/D) metal furniture and computer desks. The company's main lines are coffeetables and end tables; the firm is adding wood, glass, and other materials to enhance the appearance of models in these lines.

Phoebe & George exports mainly to the U.S., but it is now making inroads in Europe with the aid of recent big-ticket orders. The company will enhance the production of European-style products in the next few years to reflect its evolving customer base.

"European-style coffeetables are sturdy and have simple lines, " says company president George Kao.

Two years ago, Kao's company began turning out bar stools, which have since become one of its hottest-selling products. Last year the company added bedroom sets to its catalog-a market that Kao feels the firm will have much success with in Europe.

Seven years ago, Phoebe & George opened a factory in the mainland China province of Guangdong. The company now operates three plants there with a total production space of 30, 000 square meters. Two of the three plants were opened last year to make new items for export to Europe. The new facilities have enabled the company to increase output by 1.5-fold from the level of a year ago.

Despite the shift of production facilities to mainland, Phoebe & George still procures high-grade iron and steel from Taiwan's China Steel Corp. (CSC) since most mainland steel is not reliable, Kao says. "We have targeted the high-end market, so we have to use high-quality materials to win the long-term confidence of our customers."

Strict quality control is another part of Phoebe & George's strategy to succeed in the upper end markets.

The company sells products on both OEM and ODM terms. Its ODM has traditionally outpaced its OEM sales, but that has changed over the past year or so, Kao says. "We especially welcome OEM orders because it guarantees our steady growth."

Phoebe & George believes that Europe is a good market for Taiwanese furniture manufacturers to expand their OEM business.

"We are also seeking foreign furniture manufacturers who have strong interest in jointly developing new products with us, " Kao says.

Big in Japan

Hsiang Shao Enterprise Co. is a veteran manufacturer of dining sets and other small indoor furniture items, many made with leather and polyvinyl carbonate (PVC).

Besides dining sets, the company also produces bar stools, clothes hangers, and occasional tables, among other high-end items at its southern Taiwan plant.

"Because of the high labor costs in Taiwan, local manufacturers need to develop high-end products, " says Kuo Jen-chih, the firm's president. "Otherwise, we can't compete with rivals in low-cost developing-economy nations."

Currently the company exports 60% of its output, mainly to Japan and South Africa. Kuo is especially optimistic about the prospects of the Japanese market following its linkup with a Japanese importer over two years ago. "The Japanese customer is very satisfied with the quality of our products, " says Kuo. "And with their help our sales to Japan have grown steadily over the past two years." Hsiang Shao will continue to develop high-end products to expand its sales to Japan in the next few years, he says.

Hsiang Shao introduces a new item every three months and it has obtained several patents in Taiwan.

Casting for Profits

Amtop Co., Ltd., founded in 1988 as Pantotex Co., Ltd., makes forged and die-cast industrial products in mainland China and Thailand with partner manufacturers there. Metal-furniture parts account for half of its total production, with construction materials and other items making up the balance.

Founded as a bicycle producer, Amtop exited the low-margin business three years ago to focus on wrought-iron and cast-iron products made at two plants in mainland China, says company president Milton Hsieh. The plants are owned by Taiwanese business associates that have a long history of producing in the mainland."

Hsieh says the firm has obtained the exclusive rights to distribute all the products made at one of the plants, located in Xiamen. "We handle all the export operations so the manufacturer can concentrate on production, " Hsieh notes.

More recently, Amtop obtained exclusive export rights from a bronze foundry located in Pattaya, Thailand. The company makes statues and vases as well as stationery, gift, and other small items.

"Although the mainland has become a world factory, Taiwanese businesspeople have used their extensive manufacturing and marketing experience to control a large portion of exports there, says Hsieh. "With more than three decades of experience in foreign trade, Taiwanese companies have won the deep confidence of international buyers."

Hsieh compares the mainland manufacturing industry to that of Taiwan's 25 years ago. "The mainland plants still rely on the assistance of Taiwanese managers, " he says.

Taiwan has lost ground to mainland producers, but Hsieh still believes that Taiwan can succeed in the international market by focusing on high-added-value products. "Manufacturing is an important benchmark of a nation's power, " he says. "What Taiwan needs the most is creativity and innovation. By enhancing research and development, Taiwan can remain an ideal place for sourcing reliable products."

Amtop plans to open a business headquarters with R&D operations in Taiwan. The company is also introducing a new corporate image and logo.

"Wages in Taiwan are higher than in neighboring countries, but Taiwan has a huge pool of talented people who can quickly design new products, " Hsieh says. "In addition, Taiwan is experienced in delivering products fast. This is a key consideration for buyers in this era of ever-intensifying global competition."

©1995-2006 Copyright China Economic News Service All Rights Reserved.